Chris Irwin, Director of Savings at Yorkshire Building Society explains how this often-overlooked product could help.

For those savers that also have a mortgage, finding the right home for your savings can sometimes be a difficult task.

Questions about whether to pay lumps off your mortgage or keep funds in an accessible savings account in case you need it, but where you’re earning less interest than you are paying on your mortgage, are some of the things that cause confusion.

There could be another option to consider. The often unheard of Offset mortgage has been around for some time, and they provide a unique way to make your savings work as hard as they can to support your finances.

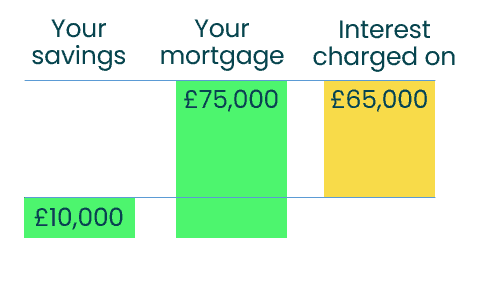

Put simply, an Offset mortgage links your mortgage with your savings to provide you with a way to use your savings to reduce the cost of your mortgage. Instead of earning interest on your savings, you reduce the amount of interest charged on your mortgage.

So the more you save, the less interest you’ll pay on your mortgage.

Using savings to pay off your mortgage sooner

There are various ways you can make your savings work for you. You can choose to pay off your mortgage sooner by paying your set mortgage payments. The money then saved in interest from the amount of savings you have reduces your overall mortgage term as you are effectively overpaying on your mortgage.

Using savings to reduce your monthly mortgage payments

Alternatively, you could use the money saved to help to reduce costs right now and use the money saved in interest to lower your monthly payments straight away. This could be a handy option if you find yourself with increased payments due to recent rate increases. It’s important to note that your mortgage and savings accounts remain separate, so you’ll always have instant access to your savings if you need it.

Getting support from others

There are other ways Offset mortgages can be used too. At Yorkshire Building Society for example, we offer Offset Plus which allows borrowers to link more savings accounts to their mortgage.

That means your family and friends savings can also be linked to your mortgage. It allows you to get financial help from your relatives or friends, yet they retain total control and ownership of their savings.

However, as their savings are linked to your mortgage, just like your savings, when your mortgage interest is calculated, their savings are considered as well, thereby either reducing your monthly payment, or shortening your mortgage term, even further.

This is often a popular way for the infamous Bank of Mum and Dad to help children/grandchildren with their mortgage without having to actually gift or give away savings that may be needed further down the line.

It’s worth remembering though that by linking others’ savings to your Offset mortgage they won’t personally get any financial benefit from the arrangement as their savings won’t earn any interest.

Equivalent savings rate

Another key advantage of Offset savings is that although your savings balance won’t grow with interest added like a traditional savings account does, the money in your savings account will benefit from the equivalent rate that you are being charged on your mortgage.

This can often be higher than what you might be earning on a traditional easy-access savings account. As mortgage rates have risen in the last twelve months the benefits of Offset savings have also increased as the equivalent savings rate is now higher.

Offset mortgage and savings accounts also have added benefits if you are a taxpayer.

The personal savings allowance (the amount you can earn in interest on your savings before having additional tax implications) is £1,000 for normal rate taxpayers, reducing to £500 for higher rate taxpayers, and nil for additional rate taxpayers.

As no interest is earned on your Offset savings it’s a tax efficient way to make your money work harder – there’s no tax to pay so there’s no impact on your personal savings allowance.

There is a lack of awareness and understanding about Offset mortgages from borrowers, and therefore it’s really important that when considering options you speak to a mortgage adviser, who will help you find the deal best suited to your needs.

Whatever option you chose for your savings, an Offset mortgage may well be one worth considering.